marzo 2017

13

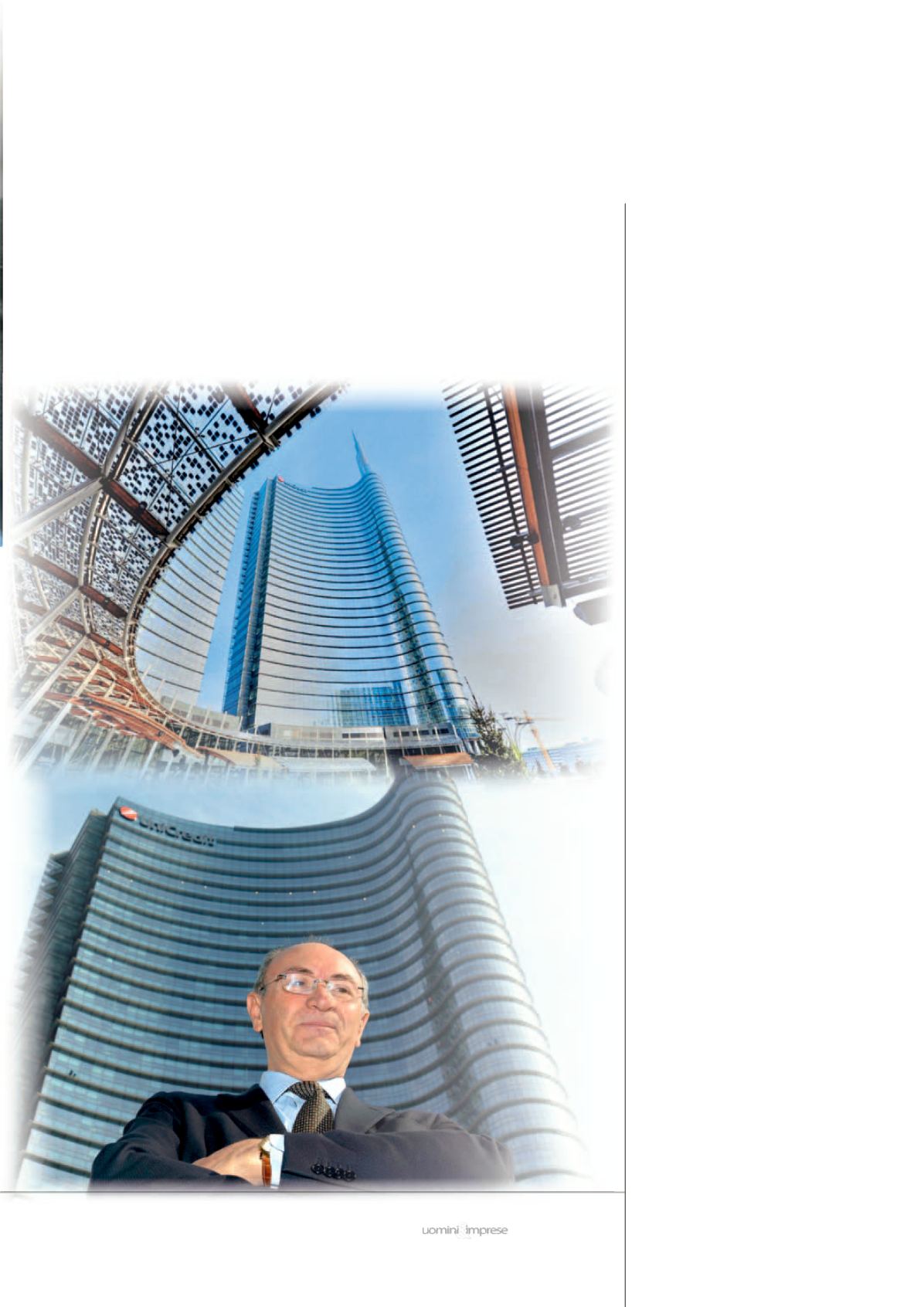

“Banks are back to being

drivers of development”

The last decade has marked a profound

change in the economic scenario

and the dynamics that regulate the

relationship between banks, companies,

and even families. The banks are in

the middle of a crucial step for their

future: amalgamations and mergers,

the occasional need for recapitalization,

implementation of digital technologies.

The risk is that the virtuous circle that

has given impetus to the Italian economy,

characterized by attention to the

territory and local businesses, will lose

its incisiveness. We talked with Federico

Ghizzoni, for the past six years managing

director of Unicredit, one of the main

symbols of Italian capitalism. “Due to the

crisis of 2008, the banking industry today

has a major reputation problem, which

can be remedied by first of all applying

clear and shared ethical principles within

the banking culture, and then attempting

to restore the role of the bank, which for

decades, for centuries, was considered

the engine of economic development.

From the first day, six years ago, when I

came aboard as CEO of Unicredit, I’ve

been convinced that the bank should go

back to doing the work of a commercial

bank. We’ve distanced ourselves from

the so-called territories and we need to

get back there. Obviously this demands

strict governance principles, insofar as

we can’t return at any cost, thus creating

the kinds of problems we’ve seen in recent

years”. For Ghizzoni, other Italian

businesses need to adapt to new scenarios:

“They’re too undercapitalized and too

dependent on credit. And globalization

means making bold decisions that can’t

be postponed, including growing in terms

of size and accelerating the generational

transition, to family members or

managers”.

vizi. Come si concilia tutto questo col

dialogo col territorio?

“Occorre trovare un equilibrio, dob-

biamo rimanere agganciati alla nostra

clientela altrimenti non riusciremo a

fare il nostro mestiere. Il tema è delica-

to: se oggi paragoniamo l’Italia ad altri

Paesi, qui c’è una presenza di filiali su-

periore alle necessità. Il percorso di ot-

timizzazione va fatto con intelligenza,

perché non bisogna lasciare territori

scoperti, e al contempo bisogna inve-

stire parecchio nello sviluppo del digi-

tale. Sul digitale occorre poi chiarirsi le

idee: fino ad oggi è servito soprattutto

per eseguire le operazioni online, quel-

le che si facevano una volta in filiale

oggi vengono eseguite tramite mobile

banking e internet banking. Ma il digi-

tale non è ancora diventato un canale

di servizi per vendere, oltre che consi-

gliare, un prodotto al cliente. Il cliente

ha tutti i giorni dei bisogni, diretti o

indiretti, legati o non legati alla banca:

con il digitale dobbiamo cercare di col-

mare questo gap, facendo in modo che